What Is Photovoltaic Solar Energy and How Does it Work?

Nowadays, it's not uncommon to find solar panels installed by…

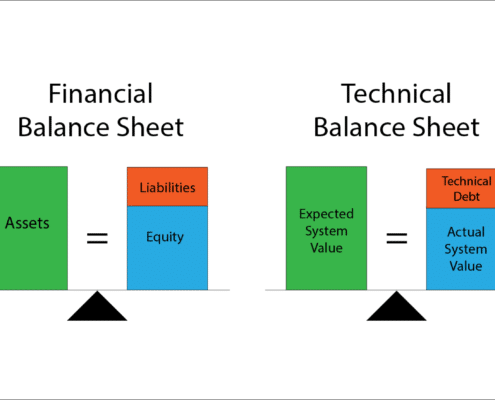

What is Technical Debt?

Technical Debt is the cost to the system owner as a result of…

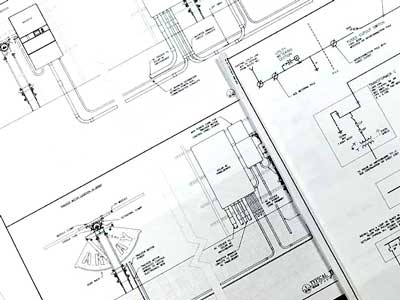

3rd Party Drawing Reviews Reduce Risk

1 Comment

/

PV Pros has been helping our clients de-risk in their assets…

Technical Due Diligence for Solar Purchase and/or Acquisitions

PV Pros has been helping our client’s de-risk in their assets…

Under-Performance - Part 2: Soiling, Snow, & Shade

Modules can underperform for a variety of environmental and non-environmental…

Effects of COVID-19 on the Solar Industry

We spend a lot of time on the phone with our clients and vendors,…

Conduct Due Diligence In-House or Hire a Specialist?

As covered in our previous articles in this series (Article…

Buyers Need an Owner’s Engineer in this Sellers’ Market

PV Pros has been helping buyers de-risk in their asset acquisition…

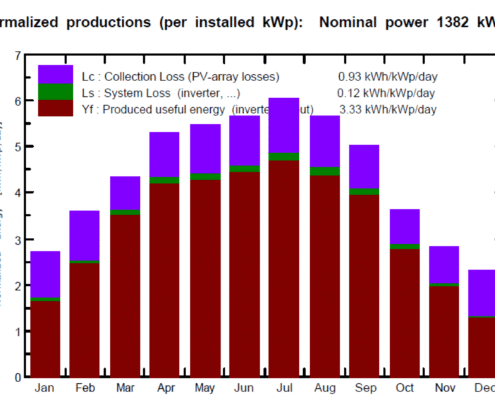

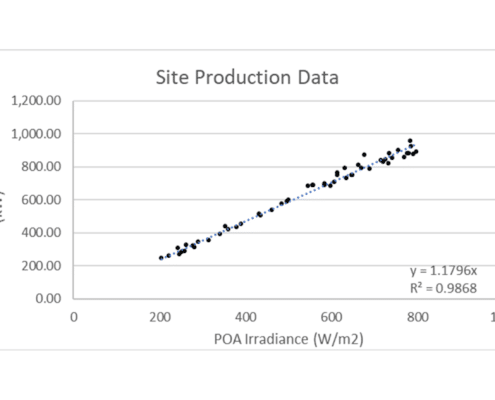

ASTM E2848 Capacity Test for Beginners

Capacity and performance ratio tests are used to demonstrate…

Acquiring Existing Photovoltaic Systems

A Photovoltaic (PV) System may change hands multiple times over…

2017 Asset Management and Performance Conference

PV Pros Director discusses the needs of O&M team integration…